FastFinPay Instant Cash Loan

Providing fast and flexible online loan services to easily meet users' financial needs. A secure and reliable loan intermediary platform that matches you with the highest quality loan products.

Product Advantages

Flexible and convenient loan services to meet your diverse needs

Flexible and Convenient

We offer a variety of loan amounts and terms to meet diverse needs

Fast Payment

Funds are instantly credited after online approval

Secure and Reliable

We utilize advanced encryption technology to strictly protect user personal information

Compliance Certifications

All loan-related services on the FastFinPay platform, including fund disbursement, risk assessment, disbursement, and repayment operations, are managed exclusively by licensed non-banking financial companies (NBFCs).

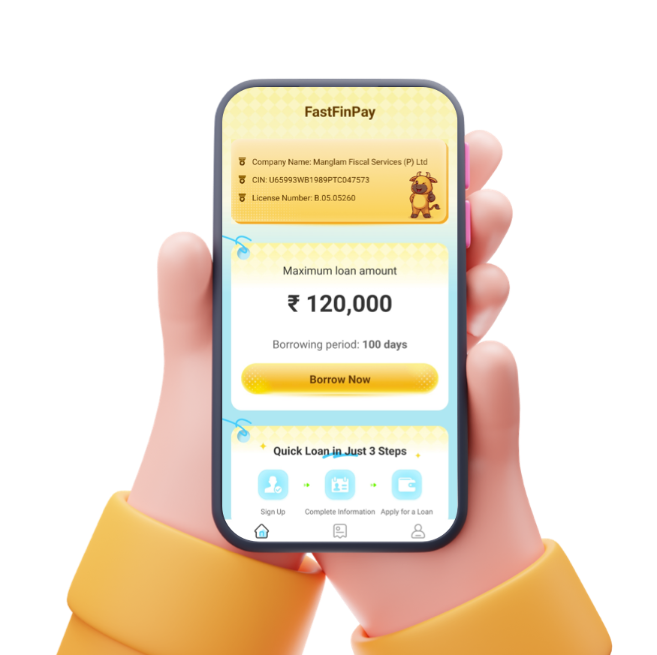

Partner Financial Institutions

Manglam Fiscal Services (P) Ltd

Company Identification Number (CIN): U65993WB1989PTC047573

NBFC Registration Number: B.05.05260

Official Website: https://www.manglamfiscal.in/

FastFinPay acts solely as a loan intermediary and does not directly provide loans. All credit-related activities are handled by the partnering non-banking financial company (NBFC) in a compliant manner.

Application Requirements

Please ensure you meet the following basic application conditions

Age Requirement

Applicants must be at least 18 years old and a legal resident of India (valid ID required)

Identity Verification

You need to submit a valid Indian ID card for real-name verification

Contact Information

You must use the mobile phone number registered with your real name

Receiving Account

A local Indian receiving account is required

Proof of Income

Proof of stable income

Application Process Description

Simple 7 steps to easily get your loan

Account Registration

Users must complete mobile phone number verification and set a login password

Information

Provide basic personal information and financial status as required

Submit Requirements

Specify the desired loan amount and loan period

Smart Recommendation

The platform automatically matches suitable loan plans based on your credit assessment

Formal Application

Confirm your selection of the appropriate loan product and submit your final application

Institutional Review

The partner financial institution will complete the qualification review within 1-3 business days

Funding

Upon approval, funds will be directly transferred to the designated bank account

Product Details

Transparent loan terms for clear borrowing

Loan Period

Flexible options, ranging from 91 days to 365 days, to meet the capital turnover needs of different users

Loan Amount

1,000 INR to 120,000 INR, with the specific amount approved determined based on the credit assessment

Annual Interest Rate

Maximum 20% (approximately 0.055% daily interest rate)

Additional Fees

No hidden fees, only principal and interest repayments

Loan calculation example

For example, if you apply for a loan of 10,000 INR with a term of 120 days (4 months):

(Note: The actual interest rate may vary depending on the user's credit status and is subject to final approval.)

Privacy Statement

We strictly adhere to Indian laws and regulations to protect user privacy. All personal information will only be used to complete loan applications and provide matching services and will not be disclosed to any third party without the user's permission. To ensure information security, we use advanced encryption technology to protect data transmission throughout the entire process.

Ready to Apply for a Loan?

Start your loan application process immediately, and we will match you with the highest quality loan products in the shortest time

Apply Now